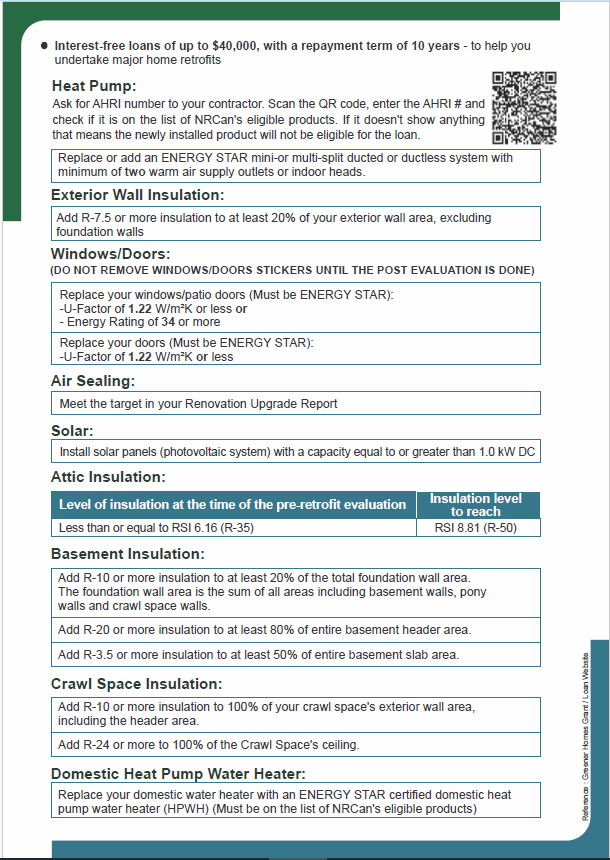

Canada Greener Homes Loan

Loan details

Maximum: $40,000

Minimum: $5,000

Repayment term: 10 years, interest-free

Loan type: Unsecured personal loan on approved credit

The quotations for this work and the retrofits chosen in the application are used to determine the maximum acceptable loan amount. Based on accepted market norms and industry standards, the maximum qualifying amount is set. If the maximum qualifying loan amount is less than the price you were quoted, you’ll be liable for making up the difference.

Each qualifying property and homeowner are only eligible for one loan each.

Only eligible products and installations that are a part of a retrofit that is both advised by an energy expert and qualified for the grant are eligible for the loan.

A portion of the financing can be given to you up front so that the construction on your home can start right away. For these kinds of projects, contractors frequently need a down payment. Upon successful completion of the retrofits and confirmation via a post-retrofit evaluation, the remaining amount of the loan will be disbursed.

Loan Eligibility

There are a few eligibility requirements to meet before applying for the loan:

- You must be eligible for and apply for the Canada Greener Homes Grant or the equivalent provincial program

- You must be a Canadian homeowner, and your home must be your primary residence

- You have completed a pre-retrofit evaluation of your home dated April 1, 2020, or later

- You have a good credit history and aren’t under:

- a consumer proposal

- an orderly payment of debt program

- a bankruptcy or equivalent insolvency proceeding

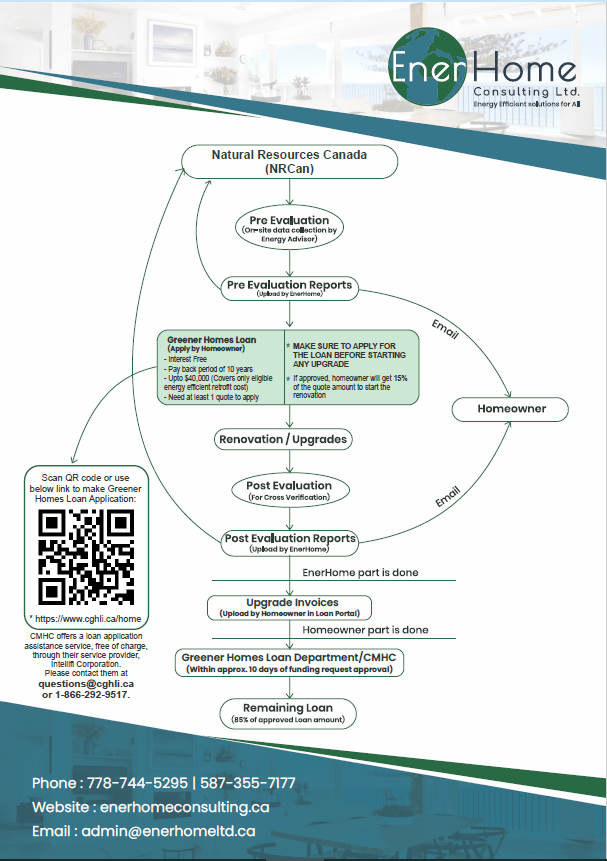

How it Works

Get a pre-retrofit EnerGuide evaluation

Plan your retrofits and get quotes from contractors

Submit an application to the loan

- Complete your retrofits and keep receipts and invoices

Get a post-retrofit EnerGuide evaluation

Receive your loan amount

Repay your loan over time

For more information, please visit - Canada Greener homes loan